pay utah state property taxes online

Other Ways To Pay. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

Send a check or money order payable to piute County Treasurer and addressed to.

. If paying after the listed due date additional amounts will be owed and billed. It does not contain all tax laws or rules. You may pay your property taxes by telephone at 877 690-3729 Jurisdiction Code 5450.

This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks. However to pay using your debit or credit card the fee will be 245 of the payment amount with a minimum fee of 150. Payments can be made online by e-check ACH debit at taputahgov.

Sorry this page is under maintenance and will be back at 800 am on October 1st 2021. You may also mail your check or money order payable to the Utah State Tax Commission with your return. File electronically using Taxpayer Access Point at taputahgov.

Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. You may pay your tax online with your credit card or with an electronic check ACH debit.

Your signed statement of personal property must be physically submitted to the assessor in order to comply with the filing requirements and avoid non-filing penalties and fees. There is no fee for e-check electronic check payments. Your bank may request the following information in order to process an e-check debit payment request.

Serving a four-year term the treasurer is the states chief financial officer and is responsible for the prudent financial management of billions of taxpayer dollars. Pay for your Utah County Real Property tax Personal Property tax online using this service. On-line Property Tax Payments NOT for prepayment.

Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. Pay online or by phone with a credit card through Instant Payments or call 1-800-764-0844There is a 25 or a minimum of 250 fee charged by Instant Payments depending on the amount of taxes owed. Please be advised our web site may be occasionally unreachable due to file maintenance.

Pay Manufactured Home Tax. Form of Payment Payment Types Accepted Online. The various taxes and fees assessed by the DMV include but are.

Online PERSONAL Property Tax Payment System. Where Do I Pay Property Taxes Utah. A separate payment is needed for each parcel.

Change Your Mailing Address. You can also pay online and avoid the hassles of mailing in a check. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property. If you do not have these please request a duplicate tax notice here. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks.

Step 1 - Online Property Tax Payments. Salt Lake County Property Tax Notice. You will need your property serial numbers.

What You Need. TAP includes many free services such as tax filing and payment and the ability to manage your account online. Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT.

See also Payment Agreement Request. Before continuing please make sure that you have the following information readily available. Salt Lake County hopes that you find paying your property taxes online a quick and simple process.

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. As the custodian of public funds.

Rememberyou can file early then pay any amount you owe by this years due date. Your Personal Property Account Number 2. This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks.

The Utah State Treasurer is a state-wide elected constitutional officer and serves Utah as part of its executive branch of state government. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. To pay directly to the Utah County Treasurer you must complete the online application available at the countys online office at 100 E Center Street Suite 1200.

Online payments do not satisfy the filing requirements as stated in UCA 59-2-307. Pub 2 Utah Taxpayer Bill of Rights contains additional information regarding taxpayer rights and responsibilities. For security reasons TAP and other e-services are not available in most countries outside the United States.

Online payments may include a service fee. Please contact us at 801-297-2200 or taxmasterutahgov for more information. CreditDebit Card or Checking Account Not a Deposit Slip.

The system provides the option of making payments directly from your credit debit card or e-check or by phone at 1-800-764-0844. They conduct audits of personal property accounts in cooperation. What You Need To Pay Online.

Please contact us at 801-297-2200 or. Pay Real Property Tax. There is no fee when paying by e-check through the online system.

See Taxpayer Access Point TAP for electronic payment options including setting up a payment agreement. Please note that our offices will be closed. Pay Business Personal Property Tax.

Online REAL Estate Property Tax Payment System. Filing Paying Your Taxes. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers.

Follow the instructions at taputahgov. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

Washington County Or Property Tax Calculator Smartasset

Colorado Property Tax Calculator Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes Calculating State Differences How To Pay

States With Highest And Lowest Sales Tax Rates

Understanding Property Taxes Lotnetwork Com

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

States With The Highest And Lowest Property Taxes Property Tax States Tax

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

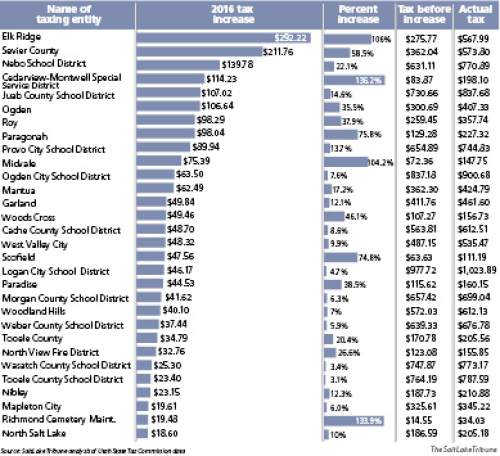

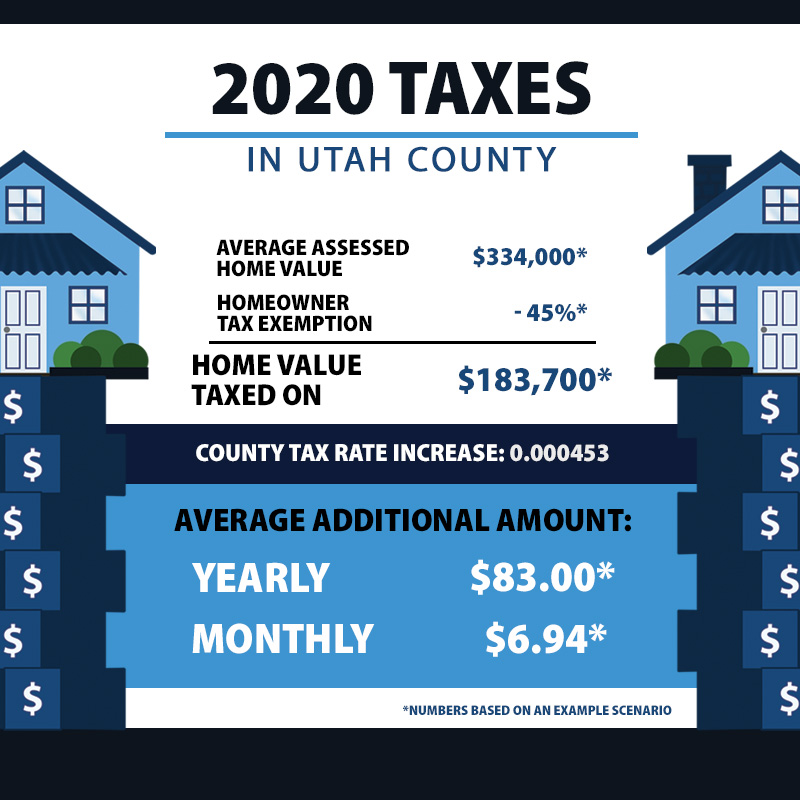

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

Property Taxes By State County Lowest Property Taxes In The Us Mapped

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)